AI Agents and the Unravelling of the Domain Industry

About me: I have been working in the domain industry since 2002, starting at Key-Systems in Germany where I helped build RRPproxy before co-founding iwantmyname in 2008. iwantmyname was acquired by CentralNic (now Team Internet) in 2019. I briefly returned in 2024/25 with OpusDNS as their Head of Customer Experience. No longer tied to any particular registrar.

I am not an industry analyst, a financial strategist, or a security researcher. I'm someone who has spent over two decades in this industry across B2B wholesale (RRPproxy), B2C retail (iwantmyname), and an acquisition, and who is now watching AI agents reshape how businesses interact with services through my current venture We Love Local. What follows is one observer's perspective, informed by experience but limited by it too.

Disclaimer: This article was written with the help of AI based on my own industry experience, analysis, and observations.

Domain registrars that build the best AI agent experience are also building the fastest exit ramp for their customers. That's the uncomfortable truth nobody in the domain industry is talking about yet.

I've spent over two decades watching this space evolve, from the early days when TLDs like .info, .biz, and .name were introduced to co-founding iwantmyname, where we got domain setup down to one click. AI agents will take it to zero clicks. And when they do, the friction that keeps customers at a registrar today could disappear entirely.

Registrars like NameSilo and name.com have built MCP servers. GoDaddy is making AI central to its business strategy and has an MCP server that works across Claude and other MCP-compatible clients, plus a ChatGPT plugin. Meanwhile Cloudflare is quietly positioning itself as the infrastructure layer everything else runs on. The rest of the industry is watching, unsure whether to move fast or wait it out.

And these are just the registrars that have built dedicated agent integrations. Most registrars already have APIs. With agentic coding tools like Claude Code, wrapping any registrar API into an MCP server (or just implementing their APIs directly) is a matter of hours, not months. The barrier to entry isn't building the integration. It's deciding to.

But before the opportunity, a word about what concerns me most. The same agent capabilities that make all of this possible also describe the most powerful domain hijacking toolkit ever conceived. I think it's coming regardless. But anyone who reads this without a knot in their stomach about security isn't paying close enough attention.

Build it and they will leave

Marc McCutcheon recently wrote about Agent Experience (AX) and how registrars that get it right early could open up an entirely new customer source. He's right. But there's a second-order question nobody seems to be asking that was briefly touched on in the comments on his post. What happens when most registrars have good AX?

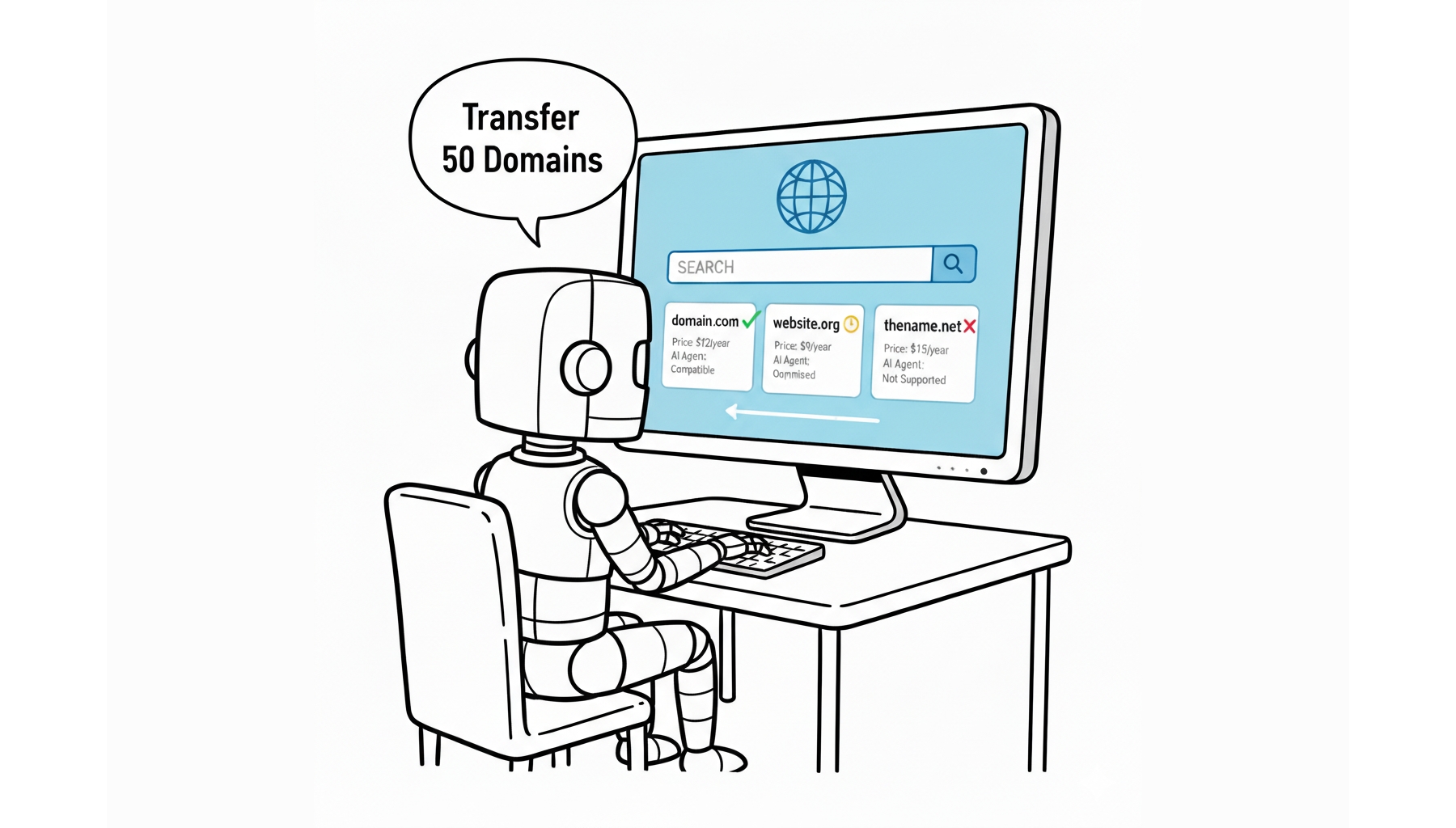

Agents will compare prices, monitor service uptime, and route customers to whoever's cheapest and most reliable. They won't really care about brand or how nice your dashboard looks. The friction that keeps customers at a registrar today disappears entirely. "Move my 50 domains to whoever's cheapest" becomes one command.

Of course, agents don't act in a vacuum. They follow user preferences, and plenty of people will tell their agent to stick with a registrar their developer knows or leave things where they are unless there's a problem. But the point is that for users who do care about price, or who simply default to "get me the best deal," the agent removes every barrier that used to stop them from acting on it.

So registrars that build great AX make it trivially easy for customers to leave, and registrars that don't build it become invisible to agents entirely.

And price is just where agents start. They'll see through the cheap registration, expensive renewal game. They'll factor in ease of management. They'll steer away from TLDs that are a pain to work with. Anyone who's dealt with certain ccTLDs knows what I mean.

What makes this even more aggressive than it first sounds: for standard gTLDs, domain transfers are remarkably automatable. Auth codes follow standard ICANN processes and an agent can retrieve the code and submit the transfer without a human touching anything via API/MCP or browser automation. The genuine friction is policy-based, i.e. the five-day waiting period, 60-day locks on new registrations and registrant changes, and registrar-specific security layers like two-factor authentication. These slow things down, but they don't fundamentally prevent automation. They just make it a multi-step process rather than an instant one.

There's also a switching cost that has nothing to do with technical friction. Credit cards on file, auto-renewal relationships, billing integrations with corporate procurement systems, expense categorisation. Even if an agent can transfer a domain in minutes, changing the billing relationship across a corporate portfolio tied into purchase orders is genuinely annoying. I'm not a CFO, but I suspect this kind of operational stickiness is underestimated in most conversations about agent-driven churn.

It's worth pausing here to note that those "annoying" delays exist for a reason. The five-day waiting period and 60-day locks aren't just bureaucratic inertia. They're the window in which a human can notice something has gone horribly wrong. When we talk about agents automating transfers at speed, we should be honest that we're also talking about shrinking the safety net.

The ccTLD landscape is a different story. The UK uses a push-based tag system. Other countries have auth codes that expire after 30 days, or impose eligibility requirements that complicate transfers. Many of the world's more than 300 ccTLDs (including internationalised variants) have their own transfer mechanisms. Universal automation across all TLDs is a much harder problem than automating the gTLD core, and businesses operating internationally often hold significant ccTLD portfolios that won't be as easy to move. But for SMBs and individuals managing mostly gTLDs, which represent a large percentage of commercial domain volume, automation removes most of the friction.

When switching the most common domain types is this easy, customer inertia stops being a moat. In practice, the bigger price pressure probably won't come from mass transfers of existing domains. For most SMBs, the difference between $12/year and $9/year isn't worth thinking about even with an agent making it painless. The real shift is in new registrations. Every new domain that an agent routes to the cheapest reliable provider is a customer the traditional registrar never gets in the first place. Portfolio holders are the exception, where margins across hundreds or thousands of names add up and agents will actively optimise.

The great unbundling

Registrars have spent years bundling services such as hosting, email, website builders, SSL certificates. The assumption was always that the registrar is the hub and customers want everything in one place.

Agents don't need a hub. They pick best of breed for each service independently. Why would an agent use a registrar's website builder when it can set up Vercel? Why use their email when it can configure Google Workspace directly?

This unbundles registrars back to what they actually are and that's purely domain registration and probably DNS (although even DNS might get unbundled separately). The value added services only matter if they're genuinely best in class. For most registrars, they're not.

The enterprise exception (for now)

This applies less to the enterprise segment, where compliance costs and integrated brand protection justify consolidated providers. Companies paying CSC or Markmonitor a premium aren't optimising for price but they're paying for legal enforcement, UDRP dispute resolution, and the comfort of a single throat to choke when something goes wrong. Agents aren't going to unbundle that overnight.

But even this segment may be less protected than it looks. The specialist knowledge that justifies those premiums (ccTLD registration policies, UDRP case law, jurisdiction-specific legal frameworks) is exactly the kind of structured domain expertise that LLMs can ingest and operationalise. As AI reshapes the legal profession more broadly, brand protection could shift from an outsourced service to an in-house capability augmented by agents, eroding another layer of registrar lock-in. That said, brand protection isn't just knowledge. It's established relationships with registries, institutional standing with WIPO panels, and speed of takedown through existing enforcement channels. An in-house team with an AI tool still needs to build those relationships, which is a slower process than ingesting the case law.

The disappearing dashboard

But for SMBs and individuals (a large portion of the market), take this to its logical conclusion and ask yourself what the registrar dashboard even is for? If agents handle discovery, DNS configuration, transfers, and service setup, the UI reduces to billing settings and a payment method. Registrars become invisible backend infrastructure, more like payment processors than the consumer brands they've tried to be.

The registrar's competitive moat was never the quality of their bundled services. It was the friction of setting them up elsewhere. Remove that friction and the moat drains.

Portfolio holders feel the squeeze

Large portfolio holders (domain investors managing thousands of names for resale or monetisation) face their own version of this squeeze. Agents make portfolio management more efficient, but they also collapse the information asymmetries that investors rely on. A buyer's agent can instantly compare aftermarket prices across every marketplace, surface brandable alternatives, and negotiate, compressing the premiums investors can charge. Meanwhile, parked domain revenue depends on human traffic that agents increasingly bypass altogether. The operational advantages of holding a large portfolio erode when every buyer has an agent that's just as good at finding and evaluating domains.

The cross-registrar layer

And if agents are orchestrating across providers, the logical next step is a layer that works across registrars. Not tied to any single one, but letting agents search, compare, transfer, and configure DNS regardless of where a domain currently sits.

That layer doesn't need to be built from scratch. OpenClaw (formerly Moltbot) is an early example of this pattern. The open-source AI agent racked up 145,000 GitHub stars in weeks by connecting to a user's services and acting across them autonomously. It's rough, the project could flame out, and it has REAL security implications (more on that shortly). It's not managing anyone's domains yet. But it shows what the architecture looks like.

The LLM people already use becomes the cross-registrar orchestration layer the moment it connects to multiple registrar APIs. Right now every MCP server is a single-registrar walled garden. The walled gardens only need to be connected, not replaced.

The reseller problem

The B2B wholesale side of the industry is even more exposed, and this is the part I know best from my years at Key-Systems. The OpenSRS/Tucows or CentralNic Reseller model is built around aggregation. Buy at volume, mark up slightly, resell to smaller providers. Resellers add value through billing integration, support infrastructure, and managing complexity on behalf of their customers.

Agents naturally replicate part of that value chain like discovery, comparison, and provisioning at scale. But resellers also provide things agents don't handle natively, such as contractual relationships, SLAs, invoicing, and liability. The commercial relationship layer has more durability than the technical one. What gets compressed is the reseller's role as a convenience layer for provisioning. If an agent can do the same aggregation and configuration work, the markup for that convenience becomes harder to justify.

This doesn't mean wholesale registrars disappear overnight. But the reseller layer that sits between them and end customers? That's where the compression might hit the hardest, particularly for resellers whose value is primarily technical rather than commercial. A reseller that mainly offers a white-label dashboard and API aggregation is doing work an agent can replicate. Compare that to a reseller that provides contractual liability, localised compliance, and hands-on account management for its customers which probably has more room to breathe.

The distinction matters because the reseller market is not one thing. It ranges from pure API pass-throughs to full-service partners, and agents put pressure on these very differently.

The elephant in the server room

Let's talk about the thing I flagged at the top. Because everything I've just described, from agents retrieving auth codes and submitting transfers to configuring DNS and orchestrating across multiple registrar APIs, is also a rather comprehensive description of what you'd want if you were building the world's most efficient domain hijacking operation.

I don't say that to be alarmist. I say it because I think agent-driven domain management is inevitable, and ignoring the security implications won't make them go away. It'll just mean we're surprised when things go wrong, which is always more embarrassing.

-

Prompt injection is the big one. An agent managing your DNS doesn't just take instructions from you. It processes context from web pages it visits, emails it reads, documents it summarises. A well-crafted injection hidden in any of those could tell your agent to update DNS records, redirect your MX to intercept email, or initiate a transfer. Researchers have already demonstrated prompt injection attacks that cause agents to take real-world actions the user never intended. Now imagine that aimed at the agent holding the keys to your domain portfolio. Pleasant dreams.

-

Cross-registrar orchestration multiplies the risk. The OpenClaw-style layer I described earlier is strategically compelling. It's also a single point of compromise. One breached agent connected to multiple registrar APIs means one attack exposes your entire portfolio across every provider simultaneously. The diversification that used to be a security advantage (i.e. spreading domains across registrars) becomes a liability when they're all accessible through one agent.

-

Speed works against you. The case for streamlining ICANN's transfer delays and 60-day locks is clear. They are friction. But they're also the security model. Those clunky, slow processes exist because speed is dangerous when you're dealing with identity infrastructure. If the industry streamlines them to accommodate agents, it's also streamlining the window in which anyone can notice a hijack in progress.

-

Agent authentication is still maturing. When an agent contacts a registrar API claiming to act on your behalf, how does the registrar verify that? The MCP specification added OAuth 2.1 as an authorisation mechanism in 2025, but it remains optional, the standard is still evolving, and most MCP servers in production today don't implement it. There's no equivalent of OAuth scopes or role-based access control that's been widely adopted for agent-to-registrar interactions specifically. Every registrar is improvising, which is exactly the kind of inconsistency attackers love.

None of this means we shouldn't build agent access. It means whoever solves agent authentication, granular permissioning, and anomaly detection doesn't just have a useful feature but the kind of moat that actually matters. The registrar (or platform layer) that becomes the trusted intermediary between agents and domain infrastructure has a far more durable competitive position than one competing on price or dashboard design. I should be clear that I'm not a security researcher, and the people who actually build these systems will have better answers than I do. But having managed domains at scale, the attack surface described above is scary.

Security isn't just a concern for the agent-driven future. It might be the business model.

What agents can't replace

So is this a doomsday scenario for registrars? I don't think so. But it is a fundamental reshaping of what matters.

Here's what I keep coming back to. Agents handle discovery, comparison, and execution brilliantly. But at some point, a human decides "yes, I want to buy from this company." And that requires a name, an identity, something verifiable.

What agents actually kill is marketing-driven brand. The billboard name, the top-of-search placement, the AI-generated social media posts. None of that matters to an agent optimising on price and reliability. But substance-driven brand is a different story. Tell your agent you care about sustainability, privacy, or supporting local business and it will filter for exactly that. Brands that stand for something verifiable get surfaced more consistently than ever because agents match on substance, not marketing spend.

This isn't hypothetical for registrars. With iwantmyname, we built a meaningful business on the idea that a registrar could be simple, transparent, and not try to upsell you into hosting you didn't need. Gandi's "No Bullshit" policy attracted a loyal following for similar reasons. Those customers were paying more than the cheapest option and knew it. They were choosing values over price, which is exactly what agent-mediated discovery should make easier, not harder. An agent told to find a registrar with transparent pricing, no dark patterns, and privacy-respecting defaults can filter for that as precisely as it filters for lowest cost.

But here's the tension. A lot of what made registrars like Gandi and iwantmyname worth choosing was the absence of bad behaviour: no bait-and-switch renewals, no aggressive upselling, no domain parking revenue games. If agent-driven price transparency forces those practices out of the market entirely, the absence of bad behaviour becomes table stakes rather than a differentiator. Cloudflare selling domains at cost isn't making a values statement. It's just a side effect of their business model. But it satisfies the same customer need.

What an agent can't evaluate is the human dimension. The feeling of supporting a small team that gave a damn about how domains should work. The trust that came from knowing an actual person would pick up the phone if something went wrong. That wasn't marketing. It was a relationship, and it's the one thing that's genuinely hard to replicate in an agent-mediated world.

Whether that kind of relationship can sustain a registrar business when agents are routing new registrations to at-cost providers by default is an open question. But for the services that sit on top of domains, such as hosting, email, and website platforms, values-based differentiation becomes a genuine competitive advantage. The agent doesn't just compare price. It compares what you stand for, if you stand for anything at all. And the need for humans to see a name they recognise and trust behind what an agent recommends? That's not going anywhere.

Where this leaves the industry

The domain industry has always been slow to change. Security concerns, low margins, and ICANN compliance create real reasons for caution. And as I've argued above, some of that caution is genuinely warranted because the security concerns aren't going to get simpler as agents get more capable. But the trajectory of agent capabilities doesn't wait for industries to be ready, or for their security models to catch up.

There's also a regulatory wildcard. ICANN could respond to agent-driven transfers by introducing new friction deliberately, such as mandatory human confirmation steps, agent-specific rate limits, or enhanced verification requirements. The organisation moves slowly, but it has moved before when domain security was at stake. Any prediction about how fast this plays out has to account for the possibility that the governing body actively slows it down.

A different kind of consolidation

What I expect is consolidation, but not the kind the industry is used to. Historically, consolidation was mostly about accumulating domain books. Team Internet absorbing competitors or smaller players, Tucows buying Enom, private equity rolling up mid-tier registrars. Scale economics and customer inertia made that playbook work.

Agent economics flips the driver. Who owns the most domains matters less than who can justify a platform around them. Registrars without a platform story become domain books waiting to be acquired by someone who has one.

Two survival strategies

The registrars that survive will probably split into two camps. Some will embrace being genuinely invisible infrastructure. Commoditised pipes that agents pull domains through, competing purely on price and API reliability, much like payment processors operate today. Others will try to build something worth a direct relationship. Membership-style services with domains at or near cost, a monthly fee for management access, and an agent-friendly layer that makes staying more valuable than switching. Something closer to the Costco model than the traditional markup-per-domain approach. Cloudflare is already straddling both by selling domains at cost as part of a broader infrastructure play. It's worth noting that this strategy only works because Cloudflare can subsidise at-cost domains with a multi-billion-dollar revenue business built on Workers, CDN, and security services. That's not a playbook most registrars can copy. It's a competitive advantage born from being something other than a registrar in the first place.

These are different survival strategies, and not every registrar can pull off the membership model. It requires a platform story compelling enough that customers (or their agents) see value beyond the domain itself. Registrars without that story default to the commodity path, where only scale economics keep the lights on.

There's also a third path that's less interesting to write about but probably describes more of the industry's actual future: managed decline. A registrar with a profitable renewal book, no debt, and low overhead can simply ride the cash flow for years without investing in a platform or competing on price. This is what private equity firms often do with acquired registrar books. They don't build platforms. They cut costs, extract cash, and let the book run down. It's not glamorous but it's financially rational. And if agent economics drives down registrar valuations, PE becomes the natural buyer because they're optimised for exactly this scenario. The platform players might not even want legacy domain books if they're already winning new registrations organically through agent routing. I'm speculating here, since M&A strategy isn't my area of expertise, but the pattern feels consistent with how PE has operated in this industry already.

It's also worth noting what unbundling does to margin structure. Domain registration margins are already thin. The margins on bundled services (hosting, email, website builders) are much higher. Strip those away and you're left with a business model built on its lowest-margin activity. Making the commodity path work requires enormous scale, which is a stronger argument for consolidation than anything else in this article.

The single-domain holder

There's a subtler dynamic at play too. Most domain holders aren't managing portfolios. They registered one name for their business years ago and barely think about it. These customers won't set up an agent to optimise their registrar. The switching cost for them isn't financial friction, it's attention friction. But agents still reshape this segment indirectly.

When someone new registers a domain, the agent recommending where to go will route toward whoever's cheapest and most reliable by default, which means the at-cost platform players like Cloudflare. New registrations concentrate toward the loss-leader providers, while traditional registrars sit on slowly decaying renewal revenue from customers who never churn but are never replaced.

Over time, this creates a bifurcated market. A handful of platform players hoovering up new registrations through agent recommendations, and a long tail of legacy registrars whose domain books become increasingly attractive acquisition targets. Not for the domains themselves, but for the customer relationships attached to them. Although "attractive" may be the wrong word. A declining renewal book is a wasting asset, and the acquisition price has to reflect the decay rate. These are harvest plays, not growth plays.

Strategic responses

The smartest registrars see this and want to become infrastructure for agents, not compete with them. GoDaddy's Agent Name Service is an attempt to extend domain-style identity to AI agents themselves. Cloudflare is building the platform agents run on. Their bet is that they can own the layer above it. Whether that works or creates a new kind of lock-in is an open question, but it's a far more interesting strategic response than just adding an AI chatbot to the dashboard.

How quickly this plays out depends on what every registrar does simultaneously. If most lock down their APIs in some ways, the few with completely open access become the default agent destinations. If most open up, pricing collapses industry-wide and only platform registrars survive. Most likely it'll be messy and uneven, with registrars opening up, seeing margin pressure, and pulling back, while the ones with a platform story push further ahead.

What about registries?

It's worth noting that registries sit in a different position to registrars. When an agent moves a domain from one registrar to another, the registry still collects the same wholesale fee. Verisign doesn't care whether your .com is at GoDaddy or Cloudflare. In that sense, registries are insulated from the registrar-level churn I've described above.

But they're not immune. Agents choosing domains for new businesses won't have human biases about which TLD sounds cool or which one their friend uses. They'll optimise on price, availability, and trust signals, and they'll steer away from TLDs that are a pain to work with. Registry operational quality becomes a selection criterion in a way it never was when humans were making the choice. TLDs that relied on marketing spend to drive awareness may lose their channel entirely.

There's also a longer-term question about whether agents reduce total registration volume. If an agent can make a single domain work harder through subdomains and efficient service routing, the need for multiple domains shrinks. That's speculative, but I'm sure it's one of the many questions registries are asking themselves even if the answer isn't clear yet.

Full circle

When we built one-click DNS configuration at iwantmyname, the vision was that connecting your domain to services should be effortless. We got it down to one click. Agents can take it to zero clicks. Not just DNS configuration, but the entire stack. Registering the domain, configuring hosting, setting up email, connecting the CDN, provisioning SSL. All in one flow, orchestrated by an agent that knows what you need before you've figured out the steps.

That's the promise. The question the industry needs to answer is what role registrars play in that world. Are they the platform the agent works through, or just the invisible pipe it pulls domains from?

And perhaps just as urgently, who's making sure the agent doing all this is actually working for you and not someone who slipped hidden instructions into a webpage you visited last Tuesday?

Nobody has a definitive answer yet, and I certainly don't claim to have one. I haven't been deep in the trenches for a while, and as a generalist at heart with a particular interest in customer experience, I'm mostly observing how agents are changing the way people interact with services and then thinking through what that could mean for registrars.

The death of the domain name has been predicted almost as many times as the death of email, and like email, it keeps stubbornly refusing to die. Whether every registrar can say the same is a different question, and the ones that start asking it now will be in a much better position than the ones that wait until agents are asking it for them.